Investment Strategy

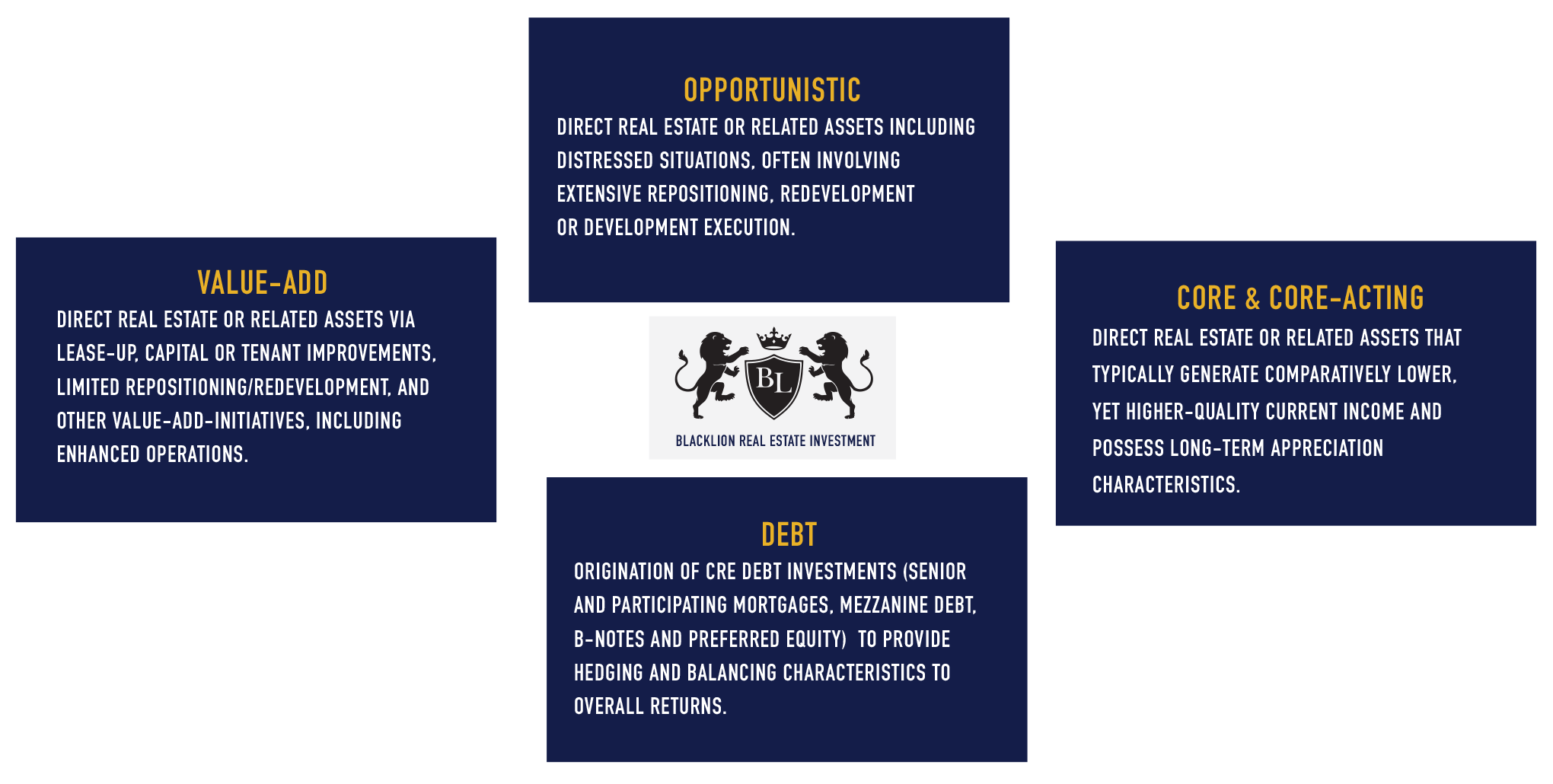

Unlike traditional investments, real estate assets are tangible, hard assets. We focus on and specialize in multifamily and industrial investments within the commercial real estate asset class. Each asset type requires highly specialized skill sets, broad platform capabilities and dedicated professionals to mitigate risk and maximize return on investment. Our unique platform, driven by local investment talent and its history of successful investing in real estate, provide investment solutions across the risk spectrum and spanning geographies to a variety of sophisticated investors. Our team brings functional expertise, as well as deep experience in:

Investment Strategy – Macro

Investment Strategy – Thematic

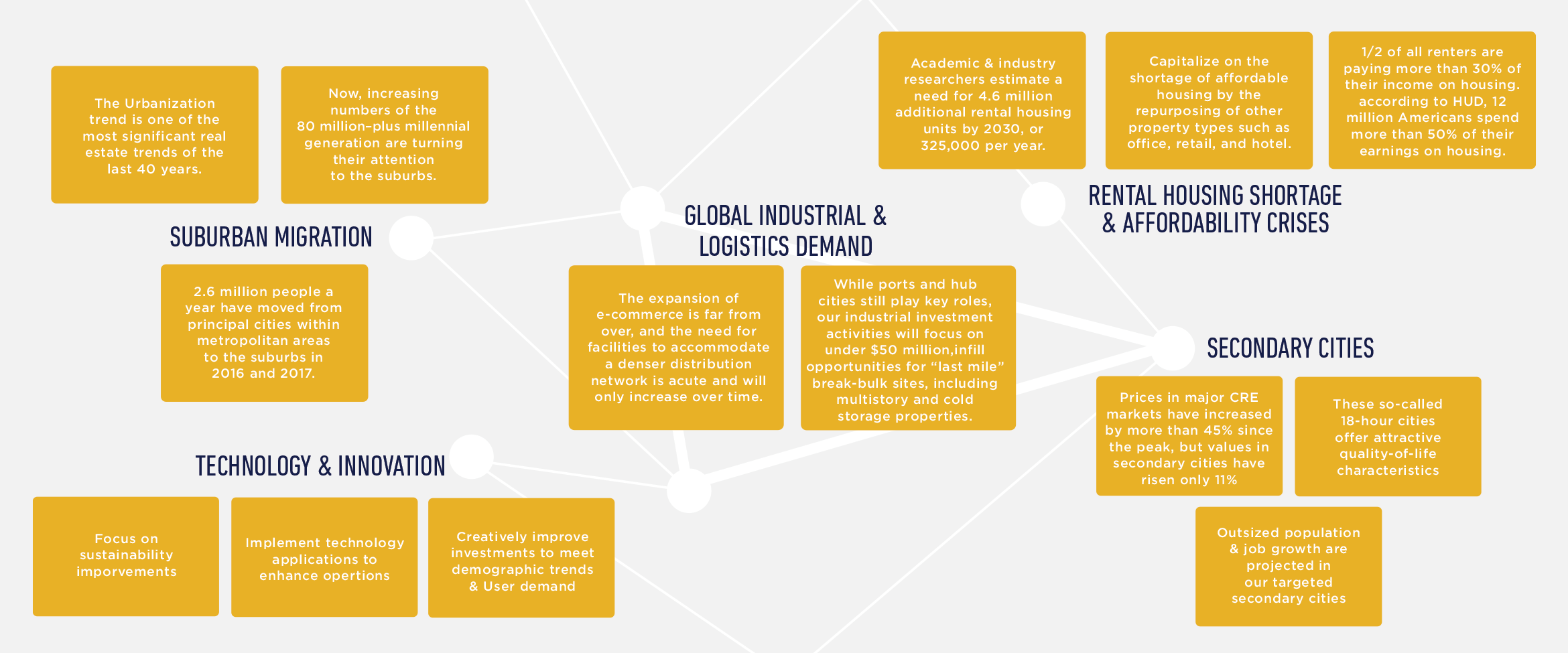

We believe the key word for real estate’s future performance is transformation—in technology and operational advances, in generational and demographic choices, in a reconfiguration of preferences by geography and markets, in multifamily and industrial assets, and in the potential for new investors in the asset class.

INVESTMENT APPROACH

TOP DOWN:

Blacklion utilizes a proprietary, comprehensive and collaborative top-down research approach to develop portfolio strategy and to identify target markets, including bottom-up research that integrates local market analysis into each investment decision.

Blacklion utilizes a comprehensive, proprietary, and collaborative top-down research approach to develop portfolio strategy and to identify target markets, including bottom-up research that integrates local market analysis into each investment decision.

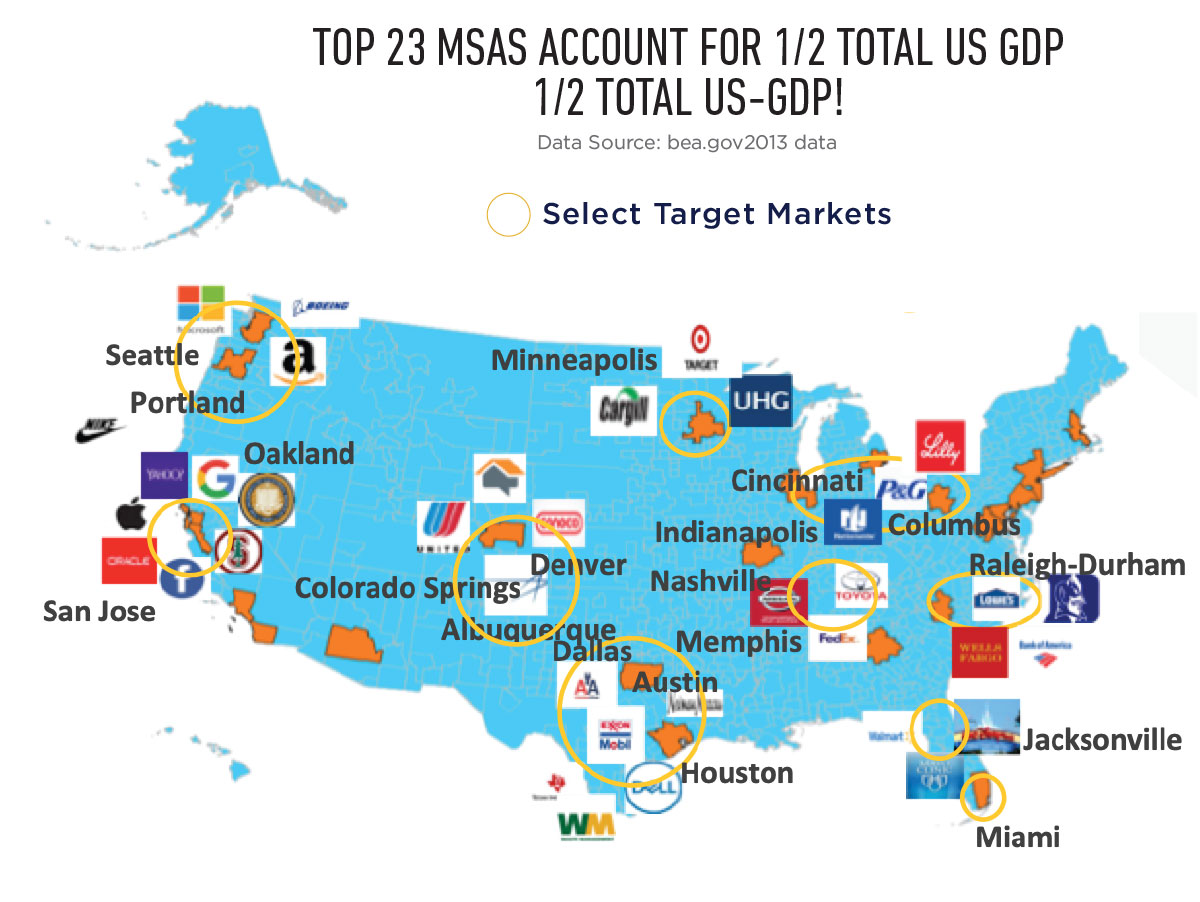

Our top down analyses always keys on population growth. We first seek out the country’s top MSA’s in terms of both raw and percentage projected positive population change from 2015 – 2030.

We next target markets within regions of the U.S. where strong population growth is forecast, together with compelling macro-job expansion and demographic trends.

We also subscribe to reputable and independent research that is used to confirm, compare and contrast our internal view and findings.

BOTTOM UP:

In a world and industry that is increasingly relying on and utilizing data, Blacklion places an emphasis on mining and developing data in support of its investment decision-making process. Our proprietary Bottom-up analyses includes, but is not limited to, the below factors:

DEMOGRAPHICS

- Millennial Growth

- Income Levels

- Two Parent & Single Parent

- Households

- Religion

- Ethnic Diversity

- Immigration

- Electorate

EMPLOYMENT

- Employers

- Industry Segmentation

- Economic Impact

- Technology & New Media Companies

- Fortune 500 Companies

- Trends

- Unions

HOUSING

- Single-Family

- Apartment Deliveries

- Rent vs. Own

- Barriers to Entry

- Suburban vs. Urban

- Affordability

EDUCATION

- Universities

- Student population

- Reputation

- R&D

- Patent Filings

- Public Schools

- Secondary

- Elementary

- Charter Schools

INVESTMENT

- Infrastructure Projects

- Construction Activity

- Foreign/

Institutional & Other - Opportunity Zones

- 5G Technology

OTHER

- Lifestyle

- Climate

- Recreation

- Services & Entertainment

- Environmental/

Green - Influences

- Education levels

- Government

- Military

- Geographical Factors

- Ports

- Major Airports

- Transportation Nodes

- Logistic Attributes

- Medical Care

- Sports Franchises

- Special Events

Target Markets

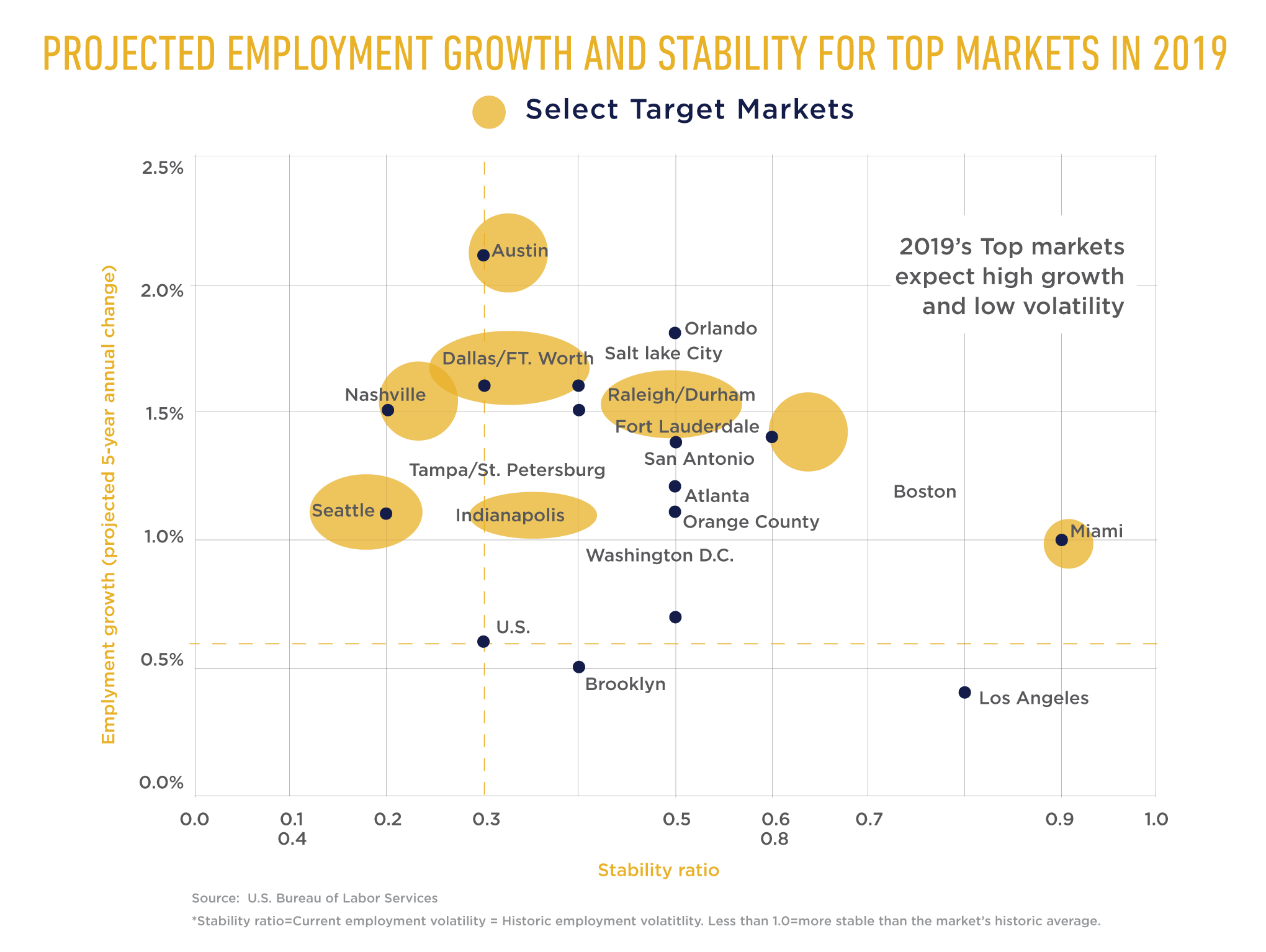

We focus on selecting markets with strong economic fundamentals that will support rent growth. Our research indicates that most tier I and tier II metros have been steadily moving up the ranks, especially versus the major U.S. metros. Strong employment growth, in-migration and investment have transformed many secondary markets into very different and substantially more diverse economies than they were during the previous economic cycle.

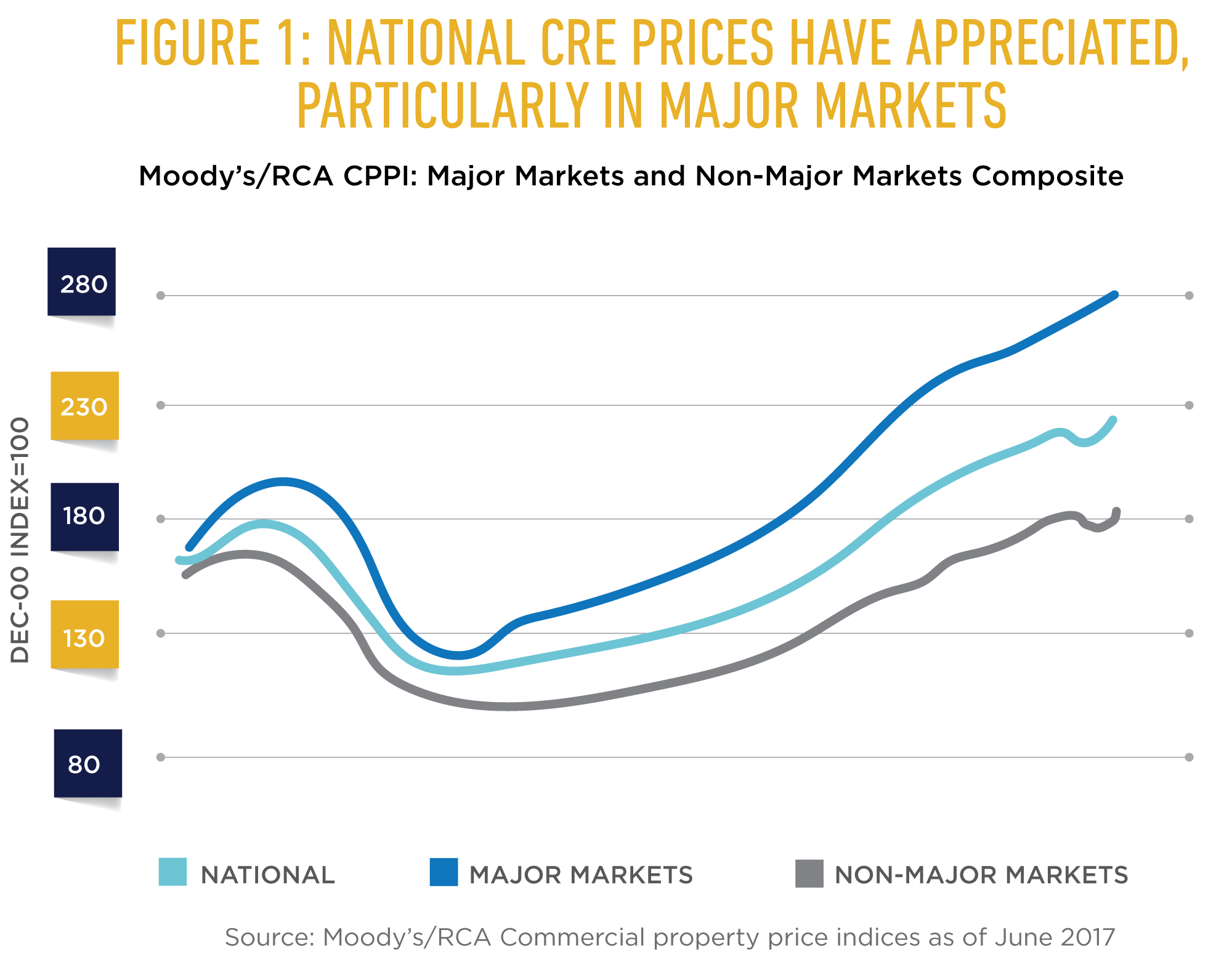

U.S. CRE prices are now 26% above the previous market peak reached in November 2007 (not adjusted for inflation), and in recent years, we have seen consistent double-digit annual appreciation, according to Moody’s/RCA Commercial Property Price Indices (CPPI). The recovery, however, has been uneven. Real estate markets perceived as safer and more liquid have benefitted the most, largely due to strong capital inflows, as investors search for yield. So while prices in major CRE markets have increased by more than 45% since the peak, values in non-major markets where Blacklion will focus its investment activities, have risen only 11% (see Figure 1 below).

Strong employment growth +

Net positive in-migration +

Comparatively attractive valuations +

A higher rate of diversification +

Relative affordability +

Quality of Life +

Influx of talented human capital

= Confidence that the economies in these markets are more protected from an isolated event disrupting their economy.

Have a question?

contact us and we will be in touch with you as soon as possible